Payment Processing Overview

To start?

To process credit card payments you need a merchant account and payment gateway.

A merchant account allows you to accept credit and debit cards, the gateway is the software that connects to the processing networks. Most gateways have both an API for web transactions as well as a web based interface for phone, mail, or fax orders.

Receiving money

For US merchant accounts, payment taken with a Visa, MasterCard or Discover will usually be deposited into the designated bank account within 2-3 business days of settlement. American Express usually takes 5 business days. International merchants might be different.

Payment methods

US merchant accounts usually combine Visa, MasterCard, Discover, JCB and sometimes American Express as the default accepted payment types. For online credit card processing, there is no difference in processing a credit or debit card that bears a major credit card association logo. Debit cards will be run as credit, as there is no online acceptance of PIN required debit cards.

After my customer submits their order?

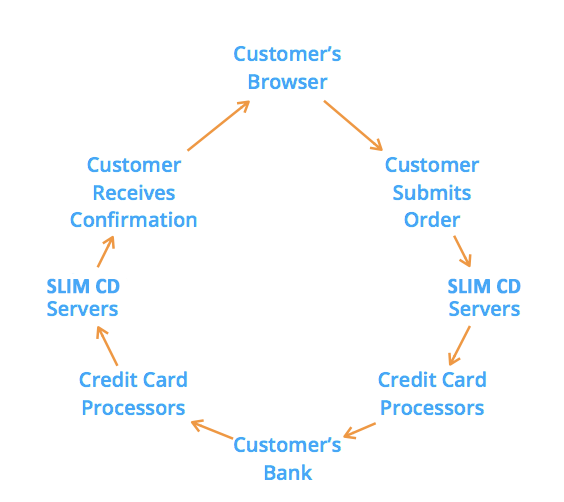

The credit card information needs to travel through a lot of different channels before it hits your bank account.

Your transactions will go through a lot of changes before they land in your merchant account.

The first step is to ask the customer’s bank if the customer’s card is legitimate and has sufficient funds to pay for your product or service. The bank lets us know if they authorize the charge to go through. Here is how we communicate with the bank:

If the cardholder’s bank doesn’t want the transaction to go through, the card is processor declined. If the cardholder’s bank says yes, the card is authorized. This puts a hold on the funds, but it doesn’t take any funds out yet. In order to collect funds, you need to submit for settlement. This is enabled by default in the Control Panel, but you have to specify whether you want to submit for settlement on creation in the API. In most cases, you’ll want to submit a transaction for settlement at the same time that you authorize the card. Usually merchants that ship physical goods wait to submit for settlement until after the product has shipped in order to prevent chargebacks.

Eventually, all of the transactions that are Submitted for Settlement will be grouped together in a Settlement Batch and sent along their way. This is when the money moves from your customer’s bank to your merchant account and eventually your own bank account. Typically this happens at the end of each day, but there are exceptions.

We’ll send those batched transactions to the credit card processors, who will ask the customer’s bank for the funds. While the processors and the banks are talking to each other, the transaction will be Settling. From there, the bank will transfer the money into your merchant account. When the money hits your merchant account, the transaction reaches the end of its journey, and is Settled. After a couple of days, you’ll see it in your bank account.