EMV PCI

- EMV chip provides an additional level of authentication at the point of sale that increases the security of a payment transaction and reduces chances of fraud.

- Once the card is entered into the merchant’s system, the cardholder’s confidential information is transmitted and stored on their network in a clear, easily accessible form, meaning it’s vulnerable for attack and use for fraud by criminals in online and other channels.

- Which is where PCI Standards come in. On top of EMV chip at the POS, they offer protections for the POS device* itself and provide layers of additional security controls** for businesses to use throughout the transaction process and across payment channels to keep card data safe – such as patching systems, monitoring for intrusions, using firewalls, managing access, developing secure software, educating employees, and having clear processes for the handling of sensitive payment card data.

When used together, EMV chip and PCI Standards are a powerful combination to increase security and reduce fraud. Protect your customers’ data and your business today.

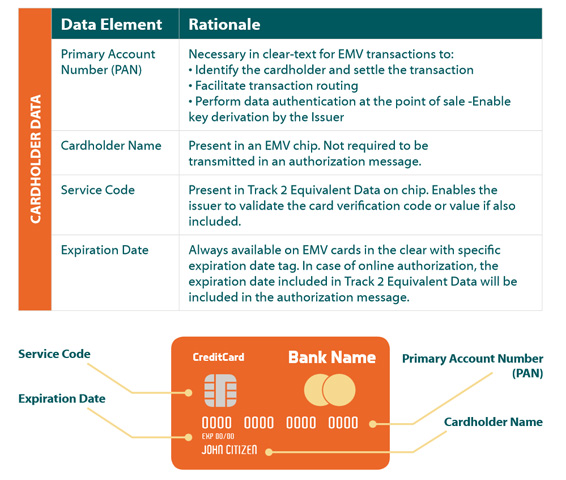

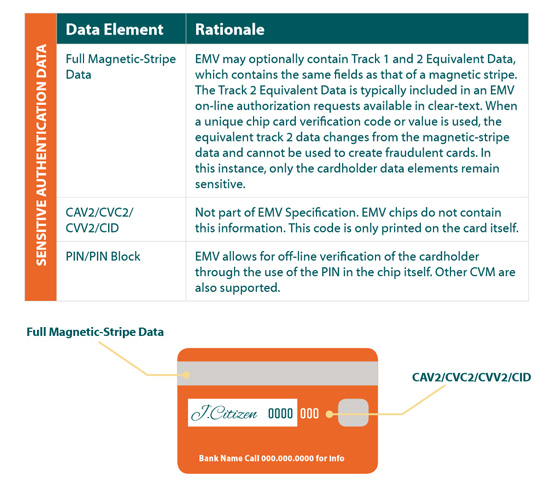

Here’s a break-down of existing data elements